IMF UPDATED GROWTH OUTLOOK AND EXPECTS LATIN AMERICA TO GROW 1.9% IN 2024

Juan Camilo Colorado / La República (Colombia)

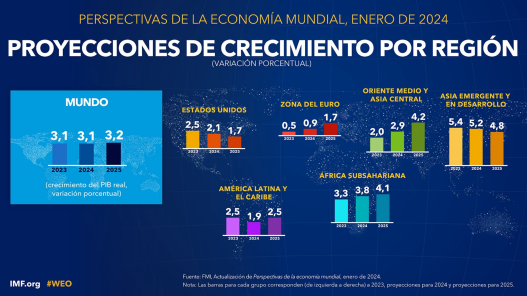

The International Monetary Fund, IMF, in its most recent quarterly world economic outlook report updated its projections for the current year. According to the entity, the world economy will grow 3.1% in accordance with its last forecast for 2023. The reasons for this growth are centered on upward revisions in the world’s largest economies, the United States and China, and assumptions that the interest rates of the world’s main central banks will fall in tandem with a reduction in inflation.

In the developed economies, growth is forecast to gradually rise from 1.6% in 2023 to 1.5% in 2024, before recovering to 1.8% in 2025. The downward revision of 0.1% for this year is due to stronger-than-expected growth in the United States, which is partly offset by weaker-than-expected growth in Europe.

Growth in the Eurozone is expected to be around 0.9% this year and 1.7% in 2025. The rise in household consumption is accompanied by a drop in energy costs (especially in Germany) and a real growth in the real income of citizens. In both Japan and the United Kingdom, the economic strengthening is expected to be moderate thanks to the depreciation of the yen and the fall, once again, in energy prices, respectively.

For Latin America and the Caribbean, growth is projected to decline from an estimated 2.5% in 2023 to 1.9% in 2024, and to increase to 2.5% in 2025, which corresponds to a downward revision of 0.4% in 2024 from the October 2023 WEO projection.

The adjustment in the projection is due to the implementation of new macroeconomic policies in Argentina to restore stability. As in other major economies in the region, improvements of 0.2% are registered for Brazil and 0.6% for Mexico, mainly due to the carry-over effects of stronger-than-expected domestic demand and higher-than-expected growth in major trading partners. With respect to Colombia, growth expectations are not yet known, but are expected to be released by the IMF in the coming days.

As for emerging and developing markets, the Fund expects their growth for this year to be 4.1% and 4.2% in 2025, with these markets in Asia being the ones that will strengthen the most. Such is the case of China (4.6% in 2024) and India (6.5% in 2024) where public spending and domestic demand are expected to remain in positive territory.

In contrast, European developing economies such as Russia’s will not grow as strongly as those in Asia, despite higher military spending due to the war with Ukraine and private consumption. The Fund estimates that Russia will grow 2.6% this year and 1.1% next year.

The Middle East and Central Asia are two regions that, according to IMF estimates, will not have substantial economic growth. The decline in forecasts focuses especially on Saudi Arabia and a multilateral agreement by OPEC to temporarily curb crude oil production in tandem with growth in non-oil sectors such as renewable energy. While last year’s estimates called for growth during 2024 to be 3.4%, the most recent update puts growth at 2.9%.

Finally, growth forecasts for sub-Saharan Africa show a sustained increase in its economy, rising from a forecast of 3.3% in 2023 to 3.8% in early 2024 and 4.1% in 2025. The reasons for the increase are centered on relief after the negative effects of weather phenomena such as El Niño and a generalized increase in demand.

With respect to inflation, the International Monetary Fund expects it to continue its downward trend, falling to 5.8% in 2024 and 4.4% in 2025. In turn, it is estimated that the inflationary decline will be more pronounced in developed economies (from 2% to 2.6% at the end of 2024) while in emerging and developing economies it would be 0.3% to 8.1%.

Likewise, they stated that this year 80% of the world’s economies could benefit from a drop in their inflation rates thanks to the moderation (improvement) of labor markets and decreases in energy prices. However, the most notorious exception is in Argentina since, as a result of Javier Milei’s macroeconomic reforms, it is expected that the elimination of price controls and the devaluation of the peso will cause inflation to increase before it starts its downward path.

The entity also stated that the main factors that would improve the outlook are a sudden drop in inflation, which would bring lower interest rates from central banks and more confidence for investment. Also, a faster economic recovery in China (partly due to the recovery from the real estate crisis) could strengthen private demand.

As for risks to economic growth in the world, the IMF mentioned the continuation of geopolitical tensions, especially in the Red Sea and Eastern Europe, which would put at risk global trade and the supply of raw materials. Similarly, if core inflation does not fall, factors such as tight labor markets and supply chain tensions would keep interest rates from falling in line with asset prices.

————

This article was originally published in the Colombian newspaper La República, with whose permission we reproduce it here.